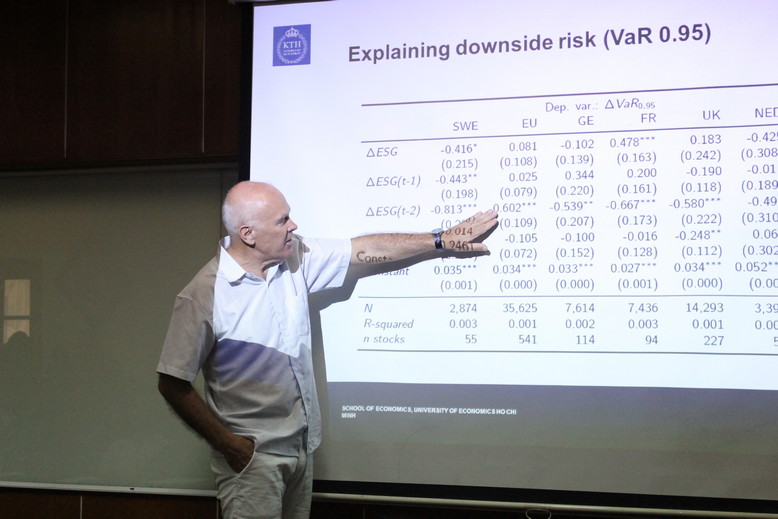

[STBI-14-03-2019] The Impact of ESG on Stocks’ Downside Risk and Risk Adjusted Return

Dear professors, lecturers, researchers, colleagues, and students,

You are cordially invited to the next UEH School of Economics STBI (Small Talks Big Ideas) seminar.

Topic: The Impact of ESG on Stocks’ Downside Risk and Risk Adjusted Return.

Presenter: Prof. Hans Lööf (KTH Royal Institute of Technology, Sweden)

Time: 11:00 – Thursday, 14 March 2019

Venue: Room H.001, Campus H, UEH School of Economics, 1A Hoang Dieu, Phu Nhuan District, Ho Chi Minh City

Language: English

Abstract:

Investments considering corporate social responsibility continue to expand. Are companies pursuing a CSR agenda benefiting shareholders by reducing their financial downside risk? This paper investigates the relationship between a firm’s environmental, social and corporate governance (ESG) scores and its downside risk on the stock market. We study this link using a panel of 887 stocks listed in five European countries over the period 2005-2017. Our empirical results show that higher ESG scores are associated with reduced downside risk of stock returns. Based on the Fama-French three-factor model, we found no systematic relationship between ESG and the level of risk-adjusted return.

The presentation: Click here

About the presenter:

Prof. Hans Lööf is the head of Division of Economics, Royal Institute of Technology. He is also the director of Centre of Excellence for Science and Innovation Studies (CESIS), Royal Institute of Technology. His research interests are innovation, knowledge spillovers, export, productivity and growth, growth, green energy.

Some photos in the seminar: